does nh tax food

But while the state has no personal income tax and no sales tax it has the fourth. Please note that effective October 1 2021 the Meals.

Does nh tax food.

. What is not taxed in New Hampshire. New Hampshire Consumer Taxes at a Glance New Hampshire does not have a sales tax and has some of the lowest gasoline taxes in the countrySince the state controls all. Is it cheaper to live in Vermont or New Hampshire.

State sales tax rate. These excises include a 9 tax on. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Accordingly New Hampshire is listed as NA with footnote 11. A 9 tax is also assessed on motor vehicle rentals. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

How does New Hampshire make money. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. A 7 tax on phone services.

The tax is 625 of the sales price of the meal. There are however several specific taxes levied on particular services or products. We include these in their state sales tax.

Does nh tax food. Does Nh Have Food Tax. New Hampshire is known as a low-tax state.

Please note recently enacted legislation. New Hampshire is one of the few states with no statewide sales tax. The 2017 maximum benefit permitted for an eligible household of three with no net income is 511 per month which is approximately 549 per person.

Does New Hampshire have food or sales tax. New Hampshire has no. Please note recently enacted legislation phases out the Interest and.

This is a flat 5 individual rate. Does Nh Have Food Tax. How much is property tax in New Hampshire.

A 9 tax is also assessed on motor vehicle rentals. For all intents and purposes however the Granite State does not have a state. Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9 to 85.

Sales Tax Treatment of. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. While New Hampshire does not collect a sales tax excise taxes are levied on the sale of certain products including alcohol cigarettes tobacco and gasoline.

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. New Hampshire currently taxes investment income and interest. Does nh tax food.

107 - 340 per gallon or 021 - 067 per 750ml. Does nh tax food. 1m9fakbx Rkyhm 1800 per 31-gallon barrel or 005 per 12-oz can.

Understanding California S Sales Tax

Kelly Goes Shopping For Sweet Food Sales Tax Repeal Settles For Gradual Reduction Kansas Reflector

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

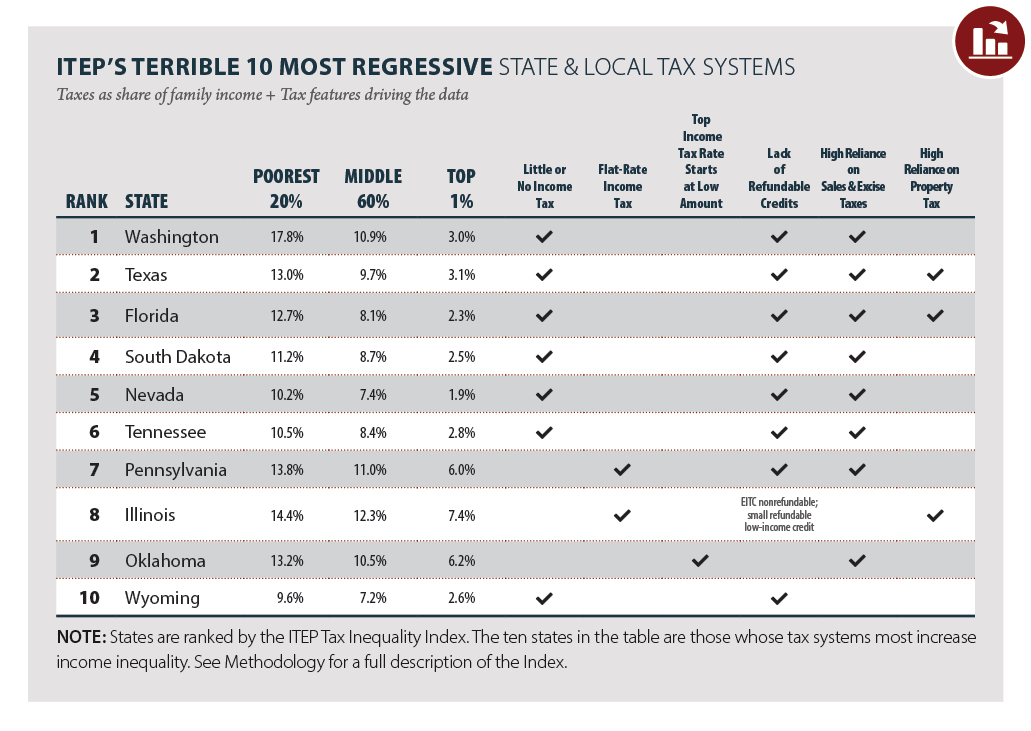

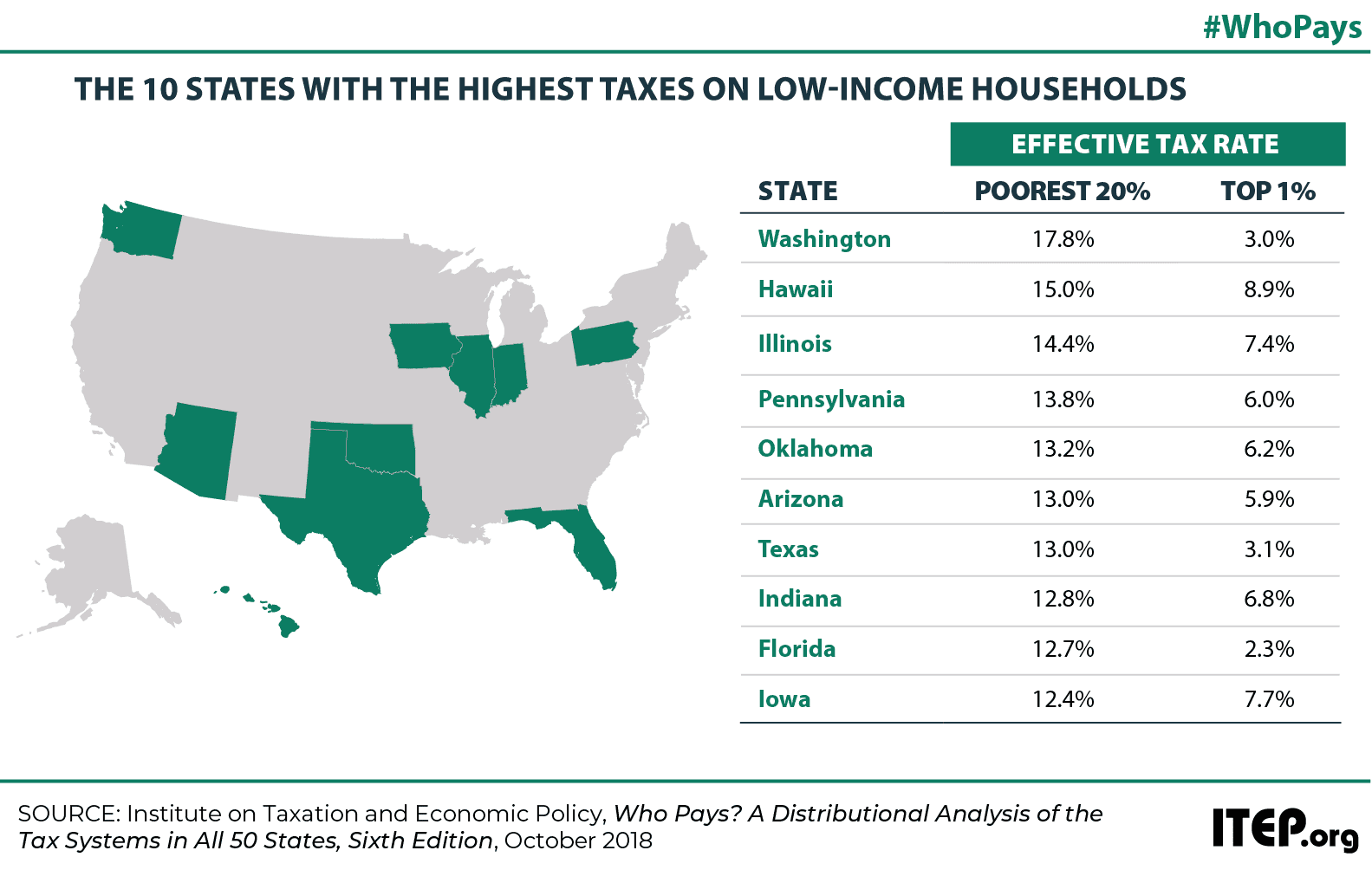

The Staggering Unfairness Of Our State Tax System

Is Living In A State With No Income Tax Better Or Worse Bankrate

General Sales Taxes And Gross Receipts Taxes Urban Institute

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

New Hampshire Sales Tax Rate 2022

Understanding New Hampshire Taxes Free State Project

The N H Mass Tax Fight Could Have Implications That Go Far Beyond Our Borders The Boston Globe

Opinion State And Local Taxes Are Worsening Inequality The New York Times

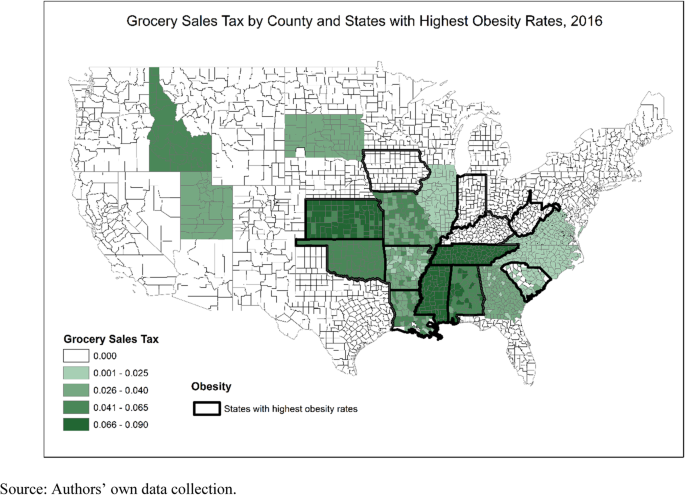

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

New Hampshire Sales Tax Handbook 2022

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

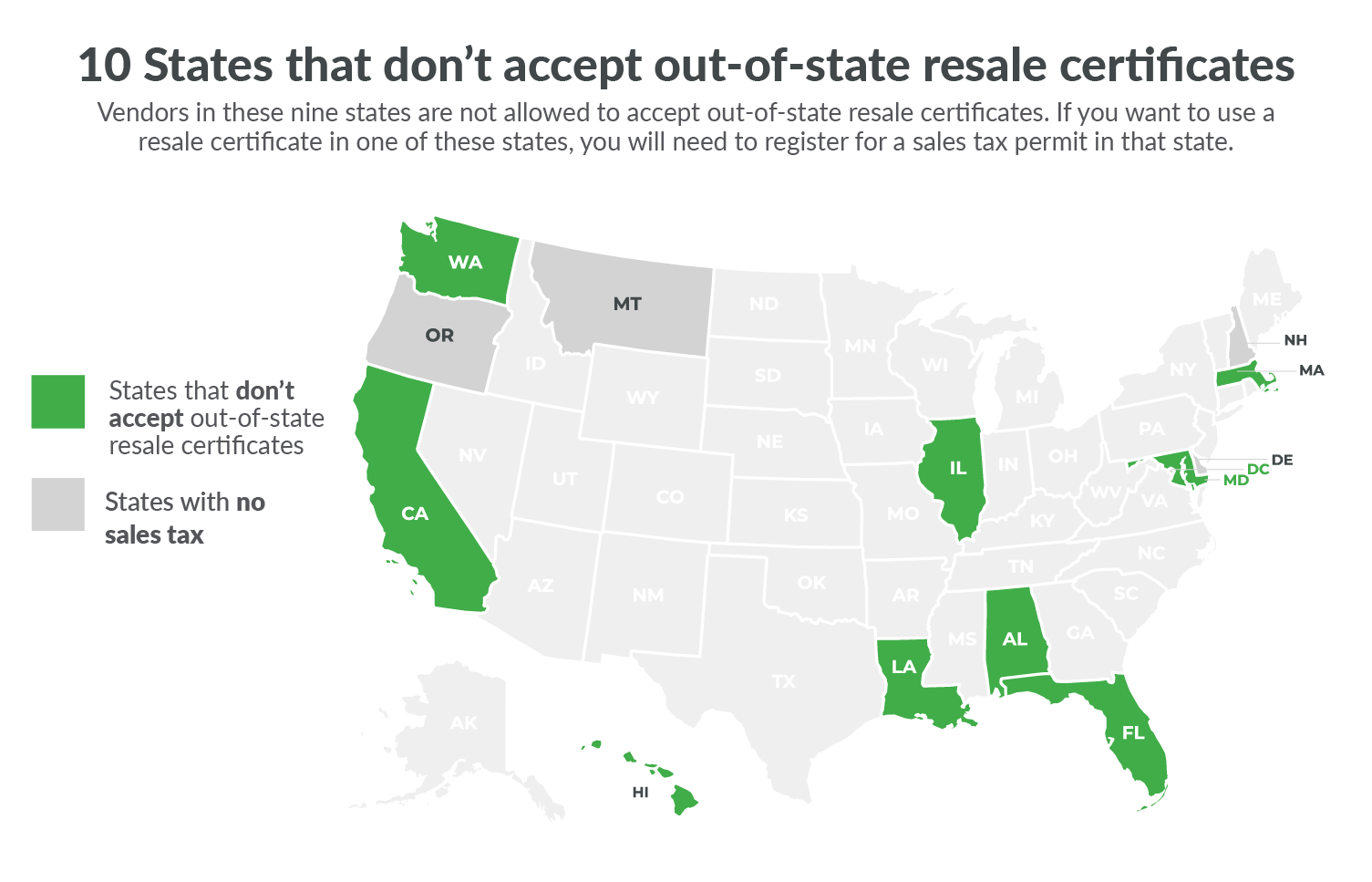

10 States That Won T Accept Your Out Of State Resale Certificate Taxjar

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger